In the past few days we’ve covered a few aspects on the financial side of your 3D printing business, namely:

- How does the flow of invoices and funds work on 3D Hubs?

- Invoices for the Service Fee from us to you, our Hubs

Today let’s take a look at how Receipts/Invoices to Customers work (as provided by our financial head @menno3d!):

Since you run your Hub as a private business and the transaction of printing & delivering the 3D print is between you and the customer, you need to provide an official tax invoice to the customer*, if required. 3D Hubs can only provide receipts.

-

Important note: Do keep in mind that it’s your responsibility to do your own bookkeeping, registration and pay local taxes (such as sales tax or VAT, or any other fees required your state/country, or the state/country of the customer if applicable).

Be sure to always consult a certified accountant if you are unsure about your local tax treatment and invoicing requirements.

In order to make tax invoices, you’ll most likely need to be registered as a company or be self employed. Make sure to consult your local Tax Authorities and Chamber of Commerce for the registration.

Order receipts (provided by 3D Hubs)

You and the customers can download a receipt for each order from the bottom of the order page or via https://www.3dhubs.com/order/\[ORDERNUMBER\]/receipt. This receipt is not an official invoice and does not include any tax that you should deduct over the order, as you as a Hub are responsible for it.

Order invoices (responsibility of you, the Hubs)

The total amount paid by the customer should include any tax (i.e. sales tax or VAT) you as a business need to pay. 3D Hubs will not display or calculate the tax you need to pay on the order page, as it is your responsibility to provide the official invoice and calculate the right amount over the order.

-

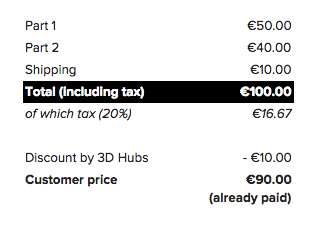

An example: if you need to pay 20% tax, we recommend you to add this 20% tax by increasing your startup and material prices by 20% to have this included in the original quote the customer receives.

If we provided a discount by 3D Hubs, this has been indicated on the order page above “Customer Pays”. Unlike discounts you would give, this does not have tax consequences for you, as this is a discount by 3D Hubs and not by you. But this is useful information for the customer, and therefore we recommend to mention this separately including the final price paid by the customer in the bottom of the invoice, see example below.

In addition, it is advisable to indicate that the invoice has already been paid, as you have already received the payment via 3D Hubs.

See invoice example below for 20% tax:

-----------

\* Apart from orders in the Fairphone project - please contact finance@3dhubs.com for questions.

So there you go. With these posts, we hope to cover all questions related to your Hub administration. Feel free to comment below, if anything is unclear or you have further questions.

Hope this information helps.

Cheers,

Gabriela